Antique Car Road Tax

The Irish Veteran and Vintage Car Club is more specific. No NCTCRW required for Vintage Vehicles.

Marendaz Car Motor Autocar Advert 1933 Car Advertising Car Ads Retro Cars

No need to register buy now.

Antique car road tax. It would be interesting if you could give an example of say buying an antique or a classic car versus a new car as a business-use vehicle. Our motor tax laws define a vintage car as one thats 30 or more years old. Classic car owners to face heavy 30 percent VAT tax rise within just four weeks CLASSIC car buyers could be forced to pay up to 30 percent more to.

Find the perfect old car tax disc stock photo. I enjoy your articles on the dollars-and-cents aspects of buying antique furniture for use in a business. The log book V5C in your name.

Appropriate fee -See List of Motor Tax Rates. Type of use Private or Company Type of vehicle Saloon or Non Saloon. Providing they havent been substantially altered cars built or registered before 1 January 1981 quality for road tax exemption from April potentially saving owners 270 or 165 if your cars engine is smaller than 1549cc.

You do not have to pay this if you. CAR TAX changes may not affect classic cars with experts pushing for owners of older models to be exempt from paying the pay per mile charges. Your vehicle tax reminder letter V11 if you have one.

For 120 grkm the tax will 050 per grkm or 60. Of a model or type no longer in production. A few more requirements need to be met in order to fully qualify.

150 to 180 6. This interpretation takes us back to 1987 when the Ford Sierra the Vauxhall Cavalier and the Austin Metro were popular. If your car is bigger than 1000cc you will be paying on 50 half of what car owners pay for in Peninsular Malaysia.

Then vehicle tax was used as a way to make the UK road system self-financing. The lower VAT rate for classic car import is part of the legislation that refers to the import of antique goods. To qualify youll need to apply at a Post Office that deals with vehicle tax bringing along your V5C V111 reminder if you have one and your MoT plus insurance cover note in.

To qualify for the low VAT rate your classic car must be. In its original state without changes to the chassis steering braking system engine etc. Historic vehicle tax exemption You can apply to stop paying for vehicle tax from 1 April 2021 if your vehicle was built before 1 January 1981.

On top of this road tax charged on used vehicles imported after the law comes into force will also include additional charges based on their age. The first tax discs were issued in 1921. How to Change Classic Car To Historic TAX 40 Years FREE ROAD TAXSo my car has finally turned 40 years old and is now eligible for Vehicle Road Tax excepti.

Lets say a 1972 Pontiac GTO versus a 2019 Lexus GS. The car must be of a type thats subject to wear and tear decay decline or exhaustion The car must be used in your trade or business. If your car was built before then itll be exempt from vehicle tax from April 2021.

You have to pay an extra 335 a year if you have a car or motorhome with a list price the published price before any discounts of more than 40000. Huge collection amazing choice 100 million high quality affordable RF and RM images. Tax Deduction for Classic or Antique Cars Used in Business.

Between 120 and 150 3. It offers this timeline. Apply at a Post Office that deals with vehicle tax.

When is a Vehicle Classed As Vintage Taxation of Vintage Veteran Vehicle A vehicle is classed as a vintageveteran once its 30 years old from date of manufacture and a concessionary rate of motor tax applies See List of Motor Tax Rates. You need to take. This means that from 1 April each year vehicles manufactured more than 40 years before 1 January of that year are automatically exempt from paying Vehicle Excise Duty VED otherwise known as road tax.

Annual road tax cannot exceed 1500. Tax Deduction for Classic or Antique Cars Used in Business. Tax exemption for classic cars is now rolling.

Of course this short answer really needs elucidation which is why I urge you to read my new article titled Tax Tips. If you dont know when. Of course all old cars are potential money pits especially if they break down but running costs arent as steep as you might imagine because insurance tax and MOT are non-existent or reduced.

You must tax your vehicle even if you do not have to. However classic cars are currently exempt. At least 30 years old.

5 Tax discs dont give car owners any more of a right to the road. The date to remember is 1 January 1981.

2018 Germany Most Popular Historic And Classic Cars Car Sales Statistics

What Is An Old Timer Explains Tuv Nord

Mot Tests Do Classic Cars Need A Mot Checks Kwik Fit

2016 Germany Most Popular Historic And Classic Cars

Wolseley Classic Cars For Sale Classic Trader

Classic Car Road Tax Exemption Now Rolling At 40 Years Classic Cars Vw Wallpaper Car Road

Classic Car Tax Exemption Explained Carbuyer

Classic Car With A 1930s Look Blaze Ev Classic 2021

Motor Tax Changes May Catch Out More Than Just The Cheats

The Fascination Of Oldtimer And Youngtimer Classic Cars Herth Buss

Is My Classic Car Eligible For Mot And Road Tax Exemption Lancaster Insurance

These Affordable French Classic Cars Are Absolute Must Haves

How To Change Classic Car To Historic Tax 40 Years Free Road Tax Youtube

The Fascination Of Oldtimer And Youngtimer Classic Cars Herth Buss

Car Shipping To Germany Ship Your Car To Germany From The Usa

1933 Rolls Royce 20 25 Enclosed Limousine Sedanca By Thrupp Maberly Classic Cars Rolls Royce Classic Cars Vintage

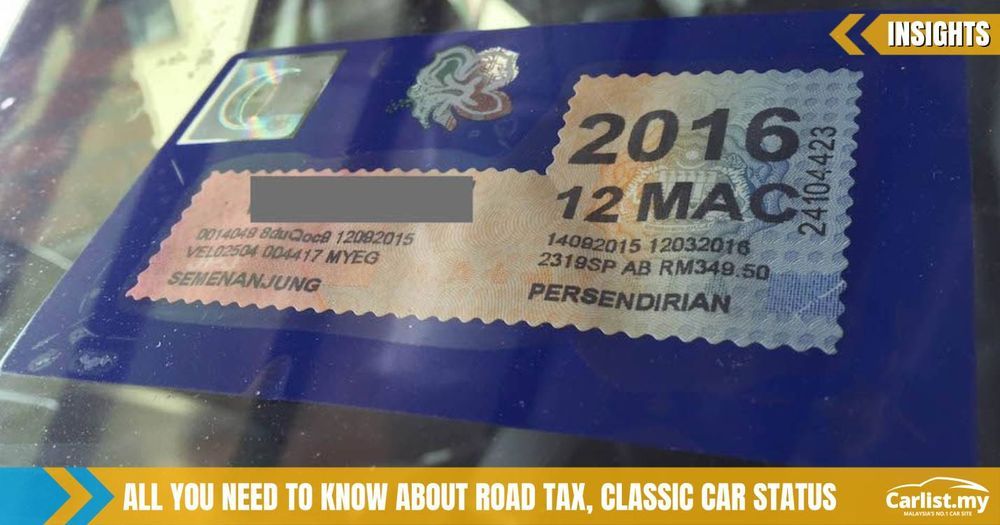

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Classic Car With A 1930s Look Blaze Ev Classic 2021

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Posting Komentar untuk "Antique Car Road Tax"